I am composing another message to Governors Newsom. I’m going for a grand funeral and burial for my niece, Drew Benton. I want the grave of Carl Janke and family EXAMINED to see if any remains are there – which I doubt. I suspect they are under the Bay tree, or, under the Westside Highway. After THE HOLE is dug, then Drew’s remains will be put on a train and brought to Redwood City, and, the daughter of Christine and Garth Bento will be put in THE HOLE. I will give a sermon as Prophet of the New Radio Church of God.

May, 12, 2025 1:30 P.M.

I just got back from Oregon Urology where I was not able to undergo a scope of my bladder due to urinary infection. On the way home the cab driver and I talked about the questions asked you on medcial forms. Is there any history of Diabetes in your family. This conversation led me to ask;

“Was Drew Rosamond Benton a Diabetic?”

In her autopsy Drew is described as obese. Did she know she was diabetic, but she could not control her diet? Was she told she could not have children. The pain I suffer – is like torture! This may be the cause of her many self-inflicted, and jumping off her building.

I have sent several messages to Gavin begging his to save my family history that is being exploited -while members of my family – ARE IGNORED – by sane people. My main complaint is Rosamond’s legacy was sold to outsiders who exploited family abuse, and fingered minor children. Was Drew afraid to SEEK HELP”

Newsom’s sincerity is being questioned.

John Presco

Women with diabetes are at a higher risk for developing various complications compared to men with diabetes, and these complications can impact their reproductive and sexual health. Diabetes can also affect women’s health differently, with some complications being more severe in women.

Key Impacts on Women’s Health:

- Heart Disease:.Opens in new tabWomen with diabetes are at a higher risk of heart disease and experience more severe complications after a heart attack compared to men.

- Reproductive Health:.Opens in new tabDiabetes can affect fertility, increase the risk of pregnancy complications like miscarriage and preeclampsia, and may worsen pre-existing diabetic retinopathy during pregnancy.

- Sexual Health:.Opens in new tabDiabetes can lead to vaginal dryness, decreased libido, and difficulty experiencing orgasm, impacting sexual pleasure and enjoyment.

- Menstrual Cycle:.Opens in new tabDiabetes can cause irregular menstrual cycles, longer periods, and heavier bleeding.

- Other Complications:.Opens in new tabWomen with diabetes are also at a higher risk of blindness, kidney disease, diabetic retinopathy, neuropathy, and depression.

- Hormonal Imbalances:.Opens in new tabDiabetes can disrupt hormone balance, impacting menstruation and fertility.

Important Considerations:

- Diabetes can affect women differently throughout their lifespan, including during menopause.

- Early detection and effective management of diabetes are crucial for minimizing complications and improving long-term health outcomes for women.

- Women with diabetes should work closely with their healthcare providers to develop individualized treatment plans and address any specific concerns related to their health.

Chazen and Newsom Do Kentfield

Posted on November 25, 2024 by Royal Rosamond Press

Nine days ago I refreshed my claim for the Mariposa Land Grant and Mine, and declared it the compass point to fight the coming corruption from the Trumpites. I forgot about Chazen and Newsom.

Christine Rosamond Benton’s favorite movie was Chinatown. There are aspects of Drew Benton’s death I dare not discuss with anyone. I no longer – trust anyone! What kind of Identity Crisis are the Newson’s suffering from? No wonder he did not come help me save the history of my great Grandfather, Carl Janke. This is the family history – to die for!

John Presco

The Golden Maltese Butterfly

Posted on November 15, 2024 by Royal Rosamond Press

San Sebastian Avenue

Three hours ago I discussed my last post with an old Leprechaun friend. and sometime foe, about my last post and the Bullhead City Police Report.

“Kentfield is a community within Marin County, the county north of San Francisco. Just over 6,800 people called the town their home as of 2020, according to the U.S. Census Bureau.

Prices of houses currently on the market in the area vary, seeking $999,000 to $21 million, according to Realtor.com. Kentfield saw homes go for a median $2.8 million as of last month.

The $9.1 million home’s roughly 5,600 square feet are spread across three floors.

There are six bedrooms and 5 ½ bathrooms within the “architecturally stunning” home, the listing said.

The house was designed with an open floor plan and boasts a chef’s kitchen. Many of its windows stretch from floor to ceiling, enabling plenty of light to shine in, photos indicated.

See Also

Gavin Newsom moves family from Sacramento to ritzy Marin County for ‘$60K-per-year private school’

Three rooms – the family room, living room and master bedroom – boast fireplaces, according to the listing.

It is replete with “multiple outdoor entertaining areas” as well as a pool and large, “lush” lawns, the listing reported. Its lot spans just shy of an acre.

The property was also described as providing high levels of privacy.

“To ensure continuity in their children’s education, the family continue to split their time between Sacramento and Marin counties,” Newsom’s office said in a statement to FOX Business when reached for comment.

Marin County is where Newsom’s children were slated to attend school beginning in the fall, according to Politico.

In the Sacramento area, the Newsoms also have a place where they reside, the source told FOX Business. A majority of the time, Newsom works from the capital city, the source added.

Newsom founded multiple businesses before his political career. He has been governor of the Golden State for over five years, with his second term having begun last year.

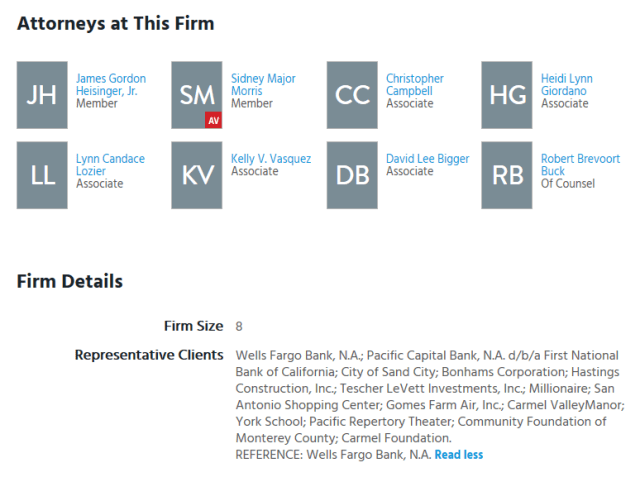

Lawrence Chazen and Family Partnership

Posted on September 5, 2011 by Royal Rosamond Press

“Meet my mortal enemy, Lawrence Chazen. He was Garth Benton’s good buddy and Vic’s private lender. Vic described Chazen as “a top financial advisor for the Getty family.” Chazen was investigated by Andrew Cuomo of HUD for loan sharking, he threatening to take the home from a black grandmother in Oakland where I grew up. I went to school with her grandchildren. As fate would have it you can see this woman’s son, Willie Aiken, in Mark’s High School football team photo. This article appeared in the Examiner in 1995 and hence I tried to warn people these crooks were collapsing our economy. I am a true prophet.”

As I type, President Obama is asking oil companies to end their tax havens, and pay more taxes. Chazen is the Director of Noble-Swiss, and Noble-Cayman. He is an expert at setting up tax shelters. He did this for the Getty Oil family who are buying up all the images on the internet.

After Grarth and Christine Benton formed a family partnership with Vic and Vicki, they formed a partnership with Lawrence Chazen in the first Rosamond Gallery in Carmel – where the family partnership prints were sold! Vic and Vicki got nothing! Chazen was the biggest creditor in the Probate, and the Bankruptcy Christine filed after filing for divorce. I filed a claim larger then Chazen’s so I could keep my families Artistic Legacy in the family, because it was being sold to an outsider – who lied to me about the family prints, she saying she had nothing to do with them.

The image of the four black girls is titled ‘Lena and Her Sisters’ . Lena was our black maid who treated us like her own children. The movie ‘The Help’ is about these anonymous bonds that Christine honored in 1986.

Victor’s best friends in high school sat atop the pyramid building in San Francisco as CEOs of TransAmerica Title, and were dismissed because of involvement in realestate loan scams. Chazen is a partner with most members of the Getty family, as well as the Pelosi’s, and Newsoms, in the PlumpJack. This is a family-like affair. This is the real history of a world famous artist, that many rich and powerful people do not want you to see. This is why Artist Anonymous was born – and unborn!

I have seen the light! I am the poor Bohemian Artist who has met his beloved Muse! And, we will set you free!

Jon Presco

Copyright 2011

I am a member in good standing of the State Bar of California and an attorney

on record for 50% interest in Shannon Rosamond. In my 16 years as a member of

the State Bar California, I have never experienced a more deliberate fraud on

any court or more reckless and calculated attempt to fraudulently take control

of a probate estate at the exclusion of the lawful heirs and total manipulation

of a tester’s intent that the present efforts of Attorney’s Robin Beare,

Lawrence J. Chazen and Garth Benton, the descendants former spouse.”

“Over the specific argument of Ms. Beare, Judge Silver refused to appoint Mr.

Chazen. Neither Ms. Beare nor Mr. Chazen disclosed to the court the very

critical fact that Mr. Chazen has the largest single creditor’s claim against

the estate and is a former business partner and business associate of Garth

Benton who the court had removed as Special Administer just moments before.”

Newsom’s annual income from 1996 to 2001 topped $439,000 per year, according to tax returns he provided. Most of it came in wages and dividends from the same Getty-backed concerns.

— Newsom’s 2000 income ballooned to more than $1.3 million thanks to an $844,000 profit he made on the sale of a Pacific Heights house he bought with Getty’s help, the returns show.

— A Getty trust paid Newsom $169,000 for investment advice from 1997-2000, Newsom said.

— When the family-owned Getty Images photographic business took its stock public in 1996, Newsom was in on the initial public offering, buying $10,000 worth. Since then, he has made $60,900 profit on trades of the stock, the tax returns show.

Trustee: Lawrence J. Chazen

Larry Chazen grew up in Iowa. He was educated at the University of Colorado where he earned a B.A. in Accounting and Law degree. His career focus has been as an investment manager and advisor. Larry is both a CPA and a member of the California Bar and, since 1994, has served on the Board of Noble Corporation – a Fortune 500 company. He is an owner of the Carmel Restaurant Group, which includes Grasing’s and Kurt’s Carmel Chop House restaurants. Larry and his wife Cece (who grew up in Pacific Grove) live in Carmel and have three children and two grandchildren. Larry enjoys hiking and travel.

OAKLAND — The lender and loan broker embroiled in controversy over the

threatened eviction of a 78-year-old Oakland widow denounced unscrupulous

lending practices, but insisted there was none in their case.

In separate interviews, broker Charles H. Oliver Jr. and San Francisco investor

Lawrence Chazen angrily objected to the cross-fire of publicity and politics

surrounding a 4-year-old loan to Mattie Aikens and her son Wilbert. Oliver and

Chazen said they’ve been the target of abusive telephone calls. Oliver operates

Homeowners Resources Corp. of Hayward along with his wife and partner, Cindy

Oliver. The Olivers said they are outraged that U.S. Department of Housing and

Urban Development officials publicly said, before investigating, that they

believed Aikens’ case was an example of predatory lending practices. He compared

himself to Richard Jewell, widely suspected of planting a bomb during the

Olympics in Atlanta until the Justice Department conceded it lacked sufficient

evidence.

“It is so akin to that situation, it is ridiculous,” said Oliver, sifting

through 2-inch-thick files of paperwork he reviewed with The Examiner on

Saturday.

Aikens borrowed $160,000 in 1993 to fix a leaking roof and aging foundation,

among other repairs. Wilbert Aikens, then 60, co-signed the loan, but both now

say they did not fully understand the terms. The 12-month loan, which Homeowners

Resources sold to Chazen a month after it was authorized, called for $1,800

monthly payments, including a $162,000 final balloon payment because of the

payment rate and interest. The Aikens say they did not expect the balloon

payment or that they might have to refinance at the end of the year, although

the loan document clearly stated the terms.

Tried to renegotiate loan

HUD began examining the loan papers last week after Aikens filed a fair housing

complaint alleging she was the victim of predatory lending because terms of the

loan were not sufficiently explained and because she was singled out as an

elderly widow and a minority. Aikens, who is African American, had almost paid

off the home when she took out the loan. She was scheduled to be evicted this

Thursday because she did not pay off or refinance the loan when the total amount

became due after one year.

Last Thursday, Chazen agreed to give her two more months to try to refinance the

loan or come up with $250,000 to buy back the house.”I think there’s a real

problem that (HUD) is trying to solve, but that this loan does not fall within

the problem,” Chazen said Friday.

“Media being misled’ “I think the media is being misled, and I think there are a

lot of political overtones from both local attorneys and politicians in

Washington,” he said. Chazen, 55, said he is uncomfortable evicting a

78-year-old grandmother, and said he knows “it’s not a flattering position to be

in.””How do I feel about it? I feel like I have to take this whole thing in

stride. I feel sorry for her,” he said Friday as he sat in the living room of

his Russian Hill home.

Chazen and Oliver say Aikens’ family made written promises to help make the

payments, which is why Oliver agreed to the loan. Only Wilbert Aikens co-signed

the loan, however.

Getting family members to help finance the loan is not uncommon and is even

encouraged by some HUD programs for low-income homeowners and seniors, Oliver

said.

Bankruptcy papers filed by Aikens show that she was receiving a total of $2,355

monthly from three of her children in addition to $1,000 income from Social

Security and her late husband’s pension – more than enough to make the $1,800

monthly payments, Oliver and Chazen contend.

Oliver said the balloon payment could have easily been refinanced if the family

had resolved a dispute with the contractor.

A beef that got out of control

Jamerson filed a lien against the house in 1994, preventing them from

refinancing the loan.”This whole thing is a beef with the contractor that got

way out of control,” said Cindy Oliver.

Chazen said he has allowed the family plenty of time to gather the money and is

only now forcing the eviction because he wants to recover what he can of his

investment. He said Aikens’ children should step forward with the cash as they

promised and pay off the loan or get another one. “If the children do not live

up to their responsibility and help her get a conventional loan, I will have to

evict her,” Chazen said. “That’s what I think is going to happen. I hope it

doesn’t come to that, but it probably will.”

Rosmary Rosamond Rides and Shoots

Posted on September 28, 2011 by Royal Rosamond Press

My mother, Rosemary, was born in Ventura, in 1926. She was the third daughter of four born to Mary Magdalene, and Royal Rosamond. Rosemary’s father was an author of three novels, and contributed to Out West and other early California magazines.

Rosemary married Victor Presco, and had four children, one who became a famous artist, known all over the world, as Rosamond.

Rosemary went to Ventura High School and dated March, a member of the Lewis family that grew lima beans in the Camarillo valley. March was in love with Rosemary till the day he died, and made sure she got this video when alas he left the beautiful life he lived.

That is Camarillo State hospital and an airport. The State of California purchased 1,776 acres from the Lewis family to build an asylum for the insane.

Rosemary was in the Waves, and left this world in 1997. Her four children are Mark, John, Christine, and Vicki. Rosemary’s movie can not be used for commercial purpouses without my permission. Historians, feel free to use this movie that is a window into a world, and a valley, that is no more. This is………….the last of the West.

Jon Presco

Copyright 2011

Getty Family Invested In Shakespeare

Posted on September 30, 2022 by Royal Rosamond Press

It’s 6:30A.M. and I awoke with a ZARDOZ hangover – to read this!

The Pelosi family may still be partners with the Getty family that gathered investors in PlumpJack. What gives?

Welcome to The Napa Asylum and Wine Vortex where it’s O.K. to feed the Apathetic!

John Presco

ENTREPRENEURIAL PARTNERS

Members of Gavin Newsom’s wine, restaurant, bar, resort and real estate partnerships since 1991:

Kevin & Bronwyn Brunner, John Burton, Casey and Michelle Cadwell, Bob and Barbara Callan, Frank Caufield, Donna Chazen, Lawrence Chazen, Joe & Victoria Cotchett, Michael & Hilary Decesare, Philip DeLimur, Don Dianda, Gretchen Dianda, Edward Everett, Richard Freemon, James Fuller, Stanlee Gatti, Robert Gerry, Andrew Getty, Ann Getty, Anna Getty, Chris Getty, Gordon Getty, Mark Getty, Peter Getty, Ronald Getty, Tara Getty, William “Billy” Getty, Robert Goldberg, Florianne Gordon, Stu Gordon, Gordon Goletto, David Goodman, Arthur Groza, Richard & Martha Guggenhime, Tony and Anthony Guilfoyle, Shelly Guyer, James & Shea Halligan, Bob & Jill Hamer, Erin Howard, Thomas Huntington, Isolep Enterprises (Paul and Nancy Pelosi family personal investment company), Peter Jacobi, Gaye Jenkins, Jeffrey Kanbar, Chad Kawai, David Lamonde, John Larson, Rob Lavoie, Leavitt/Weaver interior designers, Marc Leland, Maryon Davies Lewis, Anne McCutcheon, Chris McCutcheon, Ross McGowan, Rich McNally, Robert & Carole McNeil, Paul Mohun, Robert Mohun, Jeff Morin, Sara Moughan, Terry Moughan, Brian Mueth, Bob Naify, Marshall Naify, John Nees, Barbara Newsom, Brennan Newsom, Catherine & David Newsom, Gavin Newsom, Patrick Newsom, Tessa Newsom, William Newsom, John O’Hara, Jack Owsley, Pacific Design, Matt Pelosi, Robynne Piggott, James Samuel Powers, Elizabeth Rice, Jeremy Scherer, Paul Scherer, Gary Schnitzer, Steve & Theresa Selover, Steve Siino, Trevor Traina, Chris Vietor, Francesca Vietor, Kenneth Weeman, Nicki West, Justin & Aridne Williams, Kevin Williams, Thomas & Kiyoko Woodhouse

House Democrats have officially drafted a bill that bans politicians, judges, their spouses and children from trading stocks — but here’s what they’re still allowed to own and do

Lauren Bird – Yesterday 8:45 AM

React|1k

Support journalism

Democrats have introduced legislation that would ban senior government officials from owning and trading stocks.

Dems introduce bill against legislators investing© Sean Gallup / Getty Images

The bill, called the Combating Financial Conflicts of Interest in Government Act, is an attempt to limit conflict of interest for public office holders and their families when it comes to their investments.

The proposed bill is wide reaching. If it’s passed, several people who hold senior public positions won’t be allowed to own or trade securities, commodities, futures, crypto currencies or other digital assets.

It’s no surprise that politicians and senior officials are well-connected people and have the inside track on new legislation that might affect a company or an industry. And while it doesn’t make them clairvoyant, it’s certainly an advantage when it comes to the market.

And the public takes note.

Legislation would limit investing options

The bill would prevent members of Congress, their spouses and dependent children, senior staffers in Congress, Supreme Court justices, federal judges, the president and the vice president, as well as members of the Federal Reserve System’s Board of Governors from taking part in active investing.

Senior officials and others affected by the bill will be required to either sell their holdings when they take their position or put them into a blind trust, where they would have no control over trades.

They would still be able to purchase diversified ETFs, diversified mutual funds, U.S. Treasury bills or bonds, state or municipal government bills or bonds and others.

Related video: Democrats Have Path to Keep House Majority: Rep. Boyle

Democrats Have Path to Keep House Majority: Rep. Boyle

Critics have been calling for such a bill for years, but the House and Senate have long resisted.

Bill comes on heels of Pelosi controversy

The introduction of the bill comes just weeks after Nancy Pelosi, the speaker of the House, faced harsh criticism when her husband, Paul, a venture capitalist, exercised his call options and purchased shares in Nvidia, a manufacturer of graphics cards.

Get the World’s Smartest CPAP from the safety of your home

The timing of his move was widely criticized. It happened soon before the Senate was expected to vote on a bipartisan bill that would see domestic chipmakers get a $52 billion subsidy.

Stay on top of the markets: Don’t miss the latest news and a steady flow of actionable ideas. Sign up now for the MoneyWise Investing newsletter for free.

The bill was passed in July and, amid the scrutiny, Paul Pelosi sold his holdings in the semiconductor manufacturer at a six-figure loss.

But months before that summer scandal, as calls for legislation to combat the issue mounted, Nancy Pelosi directed the House Administration Committee to draft a bill back in February.

Conflict bill is a long time coming

The feeling that the well-connected in Congress have a leg up on the market has been growing over the years.

A survey, commissioned by conservative advocacy group Convention of States Action earlier this year, showed that more than 75% of voters believe lawmakers have an unfair advantage when it comes to trading in the stock market.

And those feelings aren’t unfounded.

A recent report from Business Insider revealed that 72 members of Congress didn’t report their financial trades as they are mandated to do by the Stop Trading on Congressional Knowledge Act of 2012.

But it may be a while yet before Congress makes a decision on the bill. The House is in its final week of the legislative session before the midterm elections and lawmakers aren’t scheduled to return until after the elections in November.

Chazen, Aikens, and Drew

Posted on August 23, 2024 by Royal Rosamond Press

I am composing another message to Governors Newsom. I’m going for a grand funeral and burial for my niece, Drew Benton. I want the grave of Carl Janke and family EXAMINED to see if any remains are there – which I doubt. I suspect they are under the Bay tree, or, under the Westside Highway. After THE HOLE is dug, then Drew’s remains will be put on a train and brought to Redwood City, and, the daughter of Christine and Garth Bento will be put in THE HOLE. I will give a sermon as Prophet of the New Radio Church of God.

I am now going to make an appeal to all the partners of PlumpJack to pay for this, because I am a pauper. We will burry a pauper who is in the Getty family tree, via Elizabeth Rosemond Taylor. Lawrence Chazen tried to become the executor of Drew and Shannon’s estate. Be careful for what you wish for!

Hey! I got a great idea. We will have a fundraiser for the Union Cemetery where all The Swells adopt a Pauper’s Grave! It will be the social event of the century! How about – a Masque Ball?

John Presco

President: Royal Rosamond Press

Members of Gavin Newsom’s wine, restaurant, bar, resort and real estate partnerships since 1991:

Kevin & Bronwyn Brunner, John Burton, Casey and Michelle Cadwell, Bob and Barbara Callan, Frank Caufield, Donna Chazen, Lawrence Chazen, Joe & Victoria Cotchett, Michael & Hilary Decesare, Philip DeLimur, Don Dianda, Gretchen Dianda, Edward Everett, Richard Freemon, James Fuller, Stanlee Gatti, Robert Gerry, Andrew Getty, Ann Getty, Anna Getty, Chris Getty, Gordon Getty, Mark Getty, Peter Getty, Ronald Getty, Tara Getty, William “Billy” Getty, Robert Goldberg, Florianne Gordon, Stu Gordon, Gordon Goletto, David Goodman, Arthur Groza, Richard & Martha Guggenhime, Tony and Anthony Guilfoyle, Shelly Guyer, James & Shea Halligan, Bob & Jill Hamer, Erin Howard, Thomas Huntington, Isolep Enterprises (Paul and Nancy Pelosi family personal investment company), Peter Jacobi, Gaye Jenkins, Jeffrey Kanbar, Chad Kawai, David Lamonde, John Larson, Rob Lavoie, Leavitt/Weaver interior designers, Marc Leland, Maryon Davies Lewis, Anne McCutcheon, Chris McCutcheon, Ross McGowan, Rich McNally, Robert & Carole McNeil, Paul Mohun, Robert Mohun, Jeff Morin, Sara Moughan, Terry Moughan, Brian Mueth, Bob Naify, Marshall Naify, John Nees, Barbara Newsom, Brennan Newsom, Catherine & David Newsom, Gavin Newsom, Patrick Newsom,

Tessa Newsom, William Newsom, John O’Hara, Jack Owsley, Pacific Design, Matt Pelosi, Robynne Piggott, James Samuel Powers, Elizabeth Rice, Jeremy Scherer, Paul Scherer, Gary Schnitzer, Steve & Theresa Selover, Steve Siino, Trevor Traina, Chris Vietor, Francesca Vietor, Kenneth Weeman, Nicki West, Justin & Aridne Williams, Kevin Williams, Thomas & Kiyoko Woodhouse.

E-mail the writers at cfinnie@sfchronicle.com, rgordon@sfchronicle.com and lwilliams@sfchronicle.com.

Belmont Historical Society Minutes

Posted on July 19, 2024 by Royal Rosamond Press

Here are the minutes of the BHS. Posted July 19,2024 at 6:16 A.M.

http://belmonthistoricalsociety.com/sites/default/files/BHS_6-9-90.pdf

Capturing Beauty

by

John Presco

ALL RIGHTS RESERVED

At no time in my five day discussion with the BHS on Facebook, did they tell me where Carl Janke and his wife were buried so I might visit their graves, something a billion Earthlings have done over the centuries, thus they defeated the purpose of cemeteries. Here is a real record of human beings getting permission to desecrate graves, and dishonor…..THE DEAD! They never dreamed they would be caught. They never had a vision of JUSTICE……arriving, one day! I can not resist employing the image above to DEMONSTRATE the real drama these people created.

I am kin to Puritan Leader, John Wilson. Cuddle by the fire, and listen to ancient tales – of the dead! You do understand the process of burial, with names on tombstones, is for the benefit of the Loved Ones? Being deprived of this, in a conspiracy – is really being played down by the Belmont City Council and the Mayor of Belmont who I made aware of this travesty on numerous occasions. The City Leaders are supposed to keep records. To not do this – is illegal! Will they use my dark reaction as a defense? How many gravestones were moved. There is just one – with three people in it. Where is the missing stone? Is Denny Lawhern talking about an old pioneer graveyard – that was IN THE WAY of a freeway? The cemetery still exists – under a thousand tons of concrete? And, the only thing the BHS can do is ask for a JANKE plaques be placed on “the fabulous Bay tree”? Is this, the title of the book and movie that – Satan made? Will God’s Justice – prevail? I want to read more discussion! How about you?

“She suggested that a plaque be placed on the fabulous Bay tree in Twin Pines Park. This is to be discussed.“

‘Denny Lawhern discussed documentation of grave site location and proof that the grave stones were removed to prevent vandalism during routing of new freeway 280. The cemetery still exists & bodies are still there . “

John Presco

President: Royal Rosamond Press

http://belmonthistoricalsociety.com/sites/default/files/BHS_6-9-90.pdf

page 1 of 3.pages.

BELMONT HIS~ORICAL SOCIETY

MINUTES

SATURDAY JUNE 9,1990

The meeting was called to order at 9:30 am by President Tom Seivert.

PRESENT:Rose Ozwirk, Ellie Woodard, Doris Vannier, Eve Sterry, Tom

Seivert,Barbara Johnson, Denn y Lawhern, Bert Johnson, Russ Estep,

Hally Rogers, Trish le Edwards,Hartley Laughead.

OLD BUSINESS:

- SECRETARY ‘S REPORT. Read and ap p roved.

2.TREASURER’S REPORT. Read and approved. Barbara Johnson presented

Financi a l Statement. Balance on hand May 31, 1990 … $1,977.02.

Russ Estep a sked if Ruth Parri s h’s du es are paid and they are up

to da t e. Tom Seivert is unab le t o get ahold of Fran Fa rme r conce rni ng an

upda t e of membership. Ellie Woodard has membe rship information

from Anna Scott f or Fran Farmer . Eve Sterry had discussion of Robert ‘s Rules of Order and distributed copy of Con s titution and by laws of Belmont Historical Societ y

Back t o the Agenda ..

1 . Report on Art and Wine Festival. Trish le Edwards reported the

people were delighted with the Room, so ld 4 pams, Donations of$20.35,

3 new members,42 Heritage Books. Total was $315. 35. Many wanted

these as gifts for children & housewarming gifts fo r neighbors .

Hartley to get more Pointers to The Past pams from AAUW. Denny

est imated over 1,000 people visit ed t h e room & 300 signed the

Guest Book. - No progress report on Belmont, As We Remember It. Anna Sco tt did

not attend the meeting. We have $250 available through a grant . It

must be used by August. Denny sugg e sted Anna Scott may need help.

Ell ie Woodard said first few pages ar e set up and plans are t o put

it on a disc when printed and available for future copies . - Eve Sterry read report on Heritage and Newsletter and h a d copies

available. Discussed infor mation on missprint of Belmont Community

Catalog which had been corrected. Tom Seivert discussed la st Board

Meeting where it was decided our Society was created primarily because we were asked to form a group by Parks and Rec. & Jim Mc Laughli

since a place was needed fo r Histrical Belmont Pictures .

Eve Sterry said she is resigning her post as Editor of the Newsletter,

if it isn’t true to history. Trish leEdwards said the Newsletter

mu s t represent views of group at large. Eve Sterry said,”Please

accept my resignation. 11 Tom Seivert accepted r esignation.

Denny Lawhern discussed documentation of grave site location and

proof that the grave stones were removed~to prevent vandalism during

routing of new freeway 280. The cemetery still exists & bodies are

still there . Records are at San Ma teo County Historical So c iety.

Doris Vannier reported that the History of Be lmo n t was b rought up

long before gravesite subject. In 1972 Doris Vannier & Ju anita Doyle

had wo rked with a group at The Belmon t Congregati on al Church & attempted to get together a Belmont History Group. Finally , Tom Seivert

was able to take over as head and made some thi ng of it. Eve Sterry

asked that it be put in the recor d that the placeme n t of grave stones

was made by ou r Society. She sugge sted that a plaque be placed on

the fabulous Bay ~ree in Twin Pines Park. Th i s is to be di scussed. - Ell ie Woodard reported on photographs from Mrs . D. Bl ank . Carlmon

Camera made negative for reproductions. There ar e now 142 it e ms in in

tory a nd new things ar e coming in. Deed o f gifts hav e been given

to a ll, c opy to donor , info on file and als o in b i nder.

Bert ,Johnson, a s Docent on Wednesday ,talked to Ea rl Miller and

identified people in picture of dog racing track . Russ Estep mentioned picture o f Florence Vannie r on Firetruc k & his ph oto of S . F .

Bay from Belmont hi lls showing Red Rock Hill. Doris Vannier has

picture of sister Flor ence, whe n 6 years old,during dedication of

cabi n in Golden Gate Park for Ca lifornia Pionee r s . Bill Kn owl and is

hol din g her hand. Ellie will have pictur e copied . Tom Seivert mentioned picture of people in grandstand at dog track from Earl Miller .

Doris Vannier sa id there were more people at the dog track than l ived

i n Belmont. There were thousands. Eve St e rr y discussed Hi s torical Bay

Tree in the Pa rk . Doris Vannier told of Carl Janke & wife being buried

there bef ore being moved to Union Cemetery in R.C. Denny suggested

further discussion & permission from City Council . Tom suggested that

this was a good idea and should be put on the agend a fo r new business - No repo rt on membership,since Fran Farmer did not attend. Denny

suggested we mu st contact Fran Fa rmer and get information by next mt g

6 . Tom Seivert r eported on display of California Express Comp any

envelopes & Historical Belmont postals at Belmont Library , which

ac companied talk on Belmont’s First Library . 20-30 p e ople attended

including a professor from S . F. State Col l ege & person involve d

wi th first Library in Belmont. Plans were made to have Gordon Seely

of S .F. State to speak to group. Intermission: Time for coffee & ” Fabu lous Lemon Squares” from

Redwo od City Heri tage Cook book, served by Trish le Edwards and Barba r

John s on.

NEW BUSINESS:

Russ Estep men tioned Mt . Vernon and trail down to River and tombstones. May be d one in a simil ar sty le here . To be discussed next meEing . Ell ie Wooda rd discussed St ationery & had it done with instructions from Park & Rec., u s ing picture of Manor Hous e by Artist ConnieMorgan.

Cost is $1 00. to sell at $3.00 each. Russ Estep moved that we

complete this this pro ject, Ros e Ozwirk 2nd . It was voted to purchase additional supplies . Barbara Johnson, as Tr easurer to pay e xpE ses . Trish to do copy work .. Voted approval.- Tom Seivert discussed Council Mtg. Tue s . June 12,1990 concern ing

Pres e rvation Survey. MvK ent Seavy , histo r y Pr o fessor f rom Monterey

will be working on p roject. There is $6 ,0 00. 0 0 avail able t o do the

Study. Volunteer s will be needed to get information & do cuments

from Co unty Cour thouse .

Doris Vannier discussed work done to trace information on El Camino

Re al Mission Bells done b y Russ Estep & Juanita Doyle . Russ said

t here were three in Belmont ; one at train station and one no rt h &

one s o uth . Discussion about Belmont train s t ation sign. Ruth Barrett Ross

Parrish has the sign and wants to know when someone can pick it up. - Victor ian Da ys i n the Park will be August 25 & 2 6 , Sat. & Sun. 10; :

5:30pm, reported by chai r person, Barba ra J ohnson . Plans were made to

dressup a nd a sign up sheet was passed.

page 3 of 3 pages. Eve Sterry said $66 worth of books were sold last time . Plans to set

up booth on Fri, August 24. Suggestions for photos, artifacts and

‘Hands On’, participatory Activities. - Plans were made for changing of meeting time to 2nd Thurs . eve .

7-8:30 p.m.Sept., Jan.,March and June, starting in Sept . to see how

it works.

Eve Sterry discussed the number of Newsle tters per year,& plans to

get one out by Sept. Doris Vannier suggested a follow-up with phone

calls. Doris Vannier suggested we ask for a duplicate key to Restroom - Denny Lawhern discussed display of tools as new acquisition. Also

picture of early Baseball team present ed by Betty Slay and Sea Scout

di spl ay,” Porthole of the-Past”, with porthole from the Barge-1959-1990

He also showed displa y of col o r e d photos of older building s in Belman

Doris Vannie Ddiscussed residents of ea r ly h omes.

Eve Sterry, as Corresponding Sec re t ary, r ead l e t t er from Belmont

Libr a rian, Linda Chiochios, with a positive comment regarding the

Historical Program & mentioned the natural partnership o f the Librar:

& the Historical Society.

Denny plans to put a mail slot on t he door for delive r y p urposes when

the room is closed . Denny sugge sted a noth er Preservation project witl

the cemetery a t Adel a ide & Chr i s t ia n Dri ve . It has b ee n there since

depression times du r ing the 1920′ s with 200 graves an d wooden markeJ

for poor people.

5 . Summer Concerts and Shakespeare Days were discussed and the suggestion was made to have the room during this peri od of Park Activiti es .

Plans were made to request another sign for directions to museum .

Trish reported on research of activities on Park during summer. Since

the room is a community effort , it should be open at peak hours . Eve

Sterry and Denny moved we accept as a group the plan to keep open

wheneve r the staff is available.

Under OTHER BUSINESS: Barbara Johnson requested permission to buy a

coffee pot for the room.Moved a nd Ell i e Woodard 2nd, al~a pproved .

Barbara Johnson suggested that any bills be turned in to her·.

Tom Seivert mentioned work projects Denny has completed, such a s the

lectern & cupboard. Eve Sterry mentioned the Guest Book, and Hartly·Lat

ead mentioned the chest of drawers & findings from the Tannery .

The meeting was adjourned at 11:50 a .m .

THE NEXT MEETING OF THE BELMONT HISTORICAL SOCIETY WILL BE HELD IN

THE EVENING ON THE SECOND THURSDAY OF SEPTEMBER: 9/13/90 at 7:30 p.m.

Respectfully submitted ,

Hally Rogers, Secreta.l!’.yr.

Wishing You Were Somehow Here Again

The Ballad of Mattie and Hattie

Posted on December 31, 2020 by Royal Rosamond Press

I found the name Charles Aikens in Ed Howard’s Oakland History.

James E Aikens is 80 Years old. James’s phone numbers include (510) 832-5610. James’s possible relatives include Walter T Aikens, Rickie W Aikens, Clyde L Aikens, Charles E Aikens, Saundra Ann Aikens, Walter T Aikens, Mattie Aikens, Linda B Boyette and Lee E Aikens.

Dear Friend; I found mention of a Charles Aikens on your page. He may be kin to my facebook friend, Darryl Aikens whose grandmother lost he home due to the predatory loan practices on my late father’s private lender, Lawrence Chazen, who was a partner in my late sister’s art gallery in Carmel. My father was convicted of loan sharking just before he died in 1994. You brother, Melvin, was going to drive me out to where my parents are buried at the Presidio. Small world.

The Mortgage Meltdown Casino | Rosamond Press

Predatory | Definition of Predatory by Merriam-Webster (merriam-webster.com)

Darryl Aikens | Rosamond Press

“I am a member in good standing of the State Bar of California and an attorney

on record for 50% interest in Shannon Rosamond. In my 16 years as a member of

the State Bar California, I have never experienced a more deliberate fraud on

any court or more reckless and calculated attempt to fraudulently take control

of a probate estate at the exclusion of the lawful heirs and total manipulation

of a tester’s intent that the present efforts of Attorney’s Robin Beare,

Lawrence J. Chazen and Garth Benton, the descendants former spouse.”

“Over the specific argument of Ms. Beare, Judge Silver refused to appoint Mr.

Chazen. Neither Ms. Beare nor Mr. Chazen disclosed to the court the very

critical fact that Mr. Chazen has the largest single creditor’s claim against

the estate and is a former business partner and business associate of Garth

Benton who the court had removed as Special Administer just moments before.”We are asking you who are connected to Oakland, West Oakland and McClymonds to look at the names on the list below and email or send a letter with the correct spelling and contact information back to us so that we may get in touch with them. We have only first names for some of the people and may have misspelled others and need contact information for all listed.

The people listed below will be the first notified in advance of notifying the general public for the premiere showing of the West Oakland Stories.

Take a look at the names of the people whom we have filmed for the West Oakland Stories of the 1940s, 50s and 60s.

This film is Oakland’s Black history being told by the people listed below in a way that you have never seen or heard before – the real Black Oakland stories.

We need your donations to complete this film. Write a check/money order now or send donation by PayPal.

Make check or money order to:

Ed Howard/WOSPFM

3591 Quail Lakes Dr. Ste. 202

Stockton CA 95207-5284OR

PayPal: UN: kakakiki@pacbell.net

Contact Phone number: 510.734.9759

Much Respect,

Ed Howard, Producer/Director

Leonard Gardner, ProducerFILMED AT DEFREMERY PARK ANNUAL REUNION 2012

Angel Carder

Barbara Nelson

Bernardo Williams

Beverly Hayes Brown

Brian McGhee

Calvin Hightower

Charles

Charles Aikens

When I heard Bob Dylan sing the ‘Lonesome Death of Hattie Carroll. I felt every cell in my body being altered, forever. I knew the Revolution was on. I heard that the Civil Rights Movement was now joined by white folks. I knew Dylan was a Jew, a Messenger, a Sage who had a way with words that were Biblical! Woodie Guthrie was a Socialist and sang some of the mostly Godly songs ever written. Consider Bernie Sanders and his faith being tested by Debbie Wasserman, in a sickening betrayal of an alliance that Bernie took part in, and was arrested. We are talking about Socialism. You got a problem with that? I’m not pushing Socialism! I’m pushing Justice.

I did not know four of my great grandfathers were Socialist Forty-Eighters who fought the Habsburg Landlords and the Papal Army they led in battle against the greatest Revolution the world…

When I heard Bob Dylan sing the ‘Lonesome Death of Hattie Carroll. I felt every cell in my body being altered, forever. I knew the Revolution was on. I heard that the Civil Rights Movement was now joined by white folks. I knew Dylan was a Jew, a Messenger, a Sage who had a way with words that were Biblical! Woodie Guthrie was a Socialist and sang some of the mostly Godly songs ever written. Consider Bernie Sanders and his faith being tested by Debbie Wasserman, in a sickening betrayal of an alliance that Bernie took part in, and was arrested. We are talking about Socialism. You got a problem with that? I’m not pushing Socialism! I’m pushing Justice.

I did not know four of my great grandfathers were Socialist Forty-Eighters who fought the Habsburg Landlords and the Papal Army they led in battle against the greatest Revolution the world has never known, for it led to the Freeing of the Slaves in ‘The Land of the Free’.

Whenever I and my two sister would visit our father, Vic Presco, he would sit us down at his kitchen table and have us go thru back issues of a Real Estate paper, looking for homeowners who were Defaulting on their home loans, then, put their name on a post card. Desperate, they would call up Captain Vic for a loan. He had private lenders lurking in the background. One of them was Lawrence Chazen, who went after Mattie Aikens’ home that she was going to proudly leave her offspring. Very few black folks own such a legacy. I believe Mattie’s home was in good part of Oakland, near where we grew up.

Here is Christine in the Getty home, and Chazen at the Rosamond gallery after Christine was dead. On the wall is her painting of ‘Lena and her Sisters’. Lena was our black maid and second mother. She would take Christine home with her for an overnight with her sisters who lived together. They were from the South.

In 1994 my father was convicted of Loan Sharking after he took a woman’s house. I do not know the color of her skin. This color was a great concern to Donald Trump and his father because their bond was based upon being Real Estate Predatorship. They believed black people did not deserve homes, should never have been set free, and, thus they were doing America a service by taking these homes away from the Rightful Owners.

When Mattie’s Oakland home got slightly knocked off its foundation, and she went looking for a loan to fix the problem, there was a another rumbling. A shock wave went through the Predator Nation. Mattie and Willie did not know what was about to hit them, and, how visible they were. The Hyenas were coming for the kill of the Lions.

The line “A beef that got out of control” is a scream, because this means the Zebra broke lose from the jaws of the ferocious meat eaters – for a little while! Chazen was a partner in both Rosamond Carmel galleries. He owns a fancy Carmel restrurant, and owns shares in the oil wells off the coast of Israel. He is a executive for Noble Oil, and helped them relocate to Switzerland so they don’t have to pay taxes. Chazen did the same for his pal, Gordon Getty, whom he is in partnership with in PlumpJack.

When I read Chazen say; “I hope it doesn’t come to this, but it probably will!” I laughed! It was already a done deal – from the get! These Hyenas see the Real Estate Market as their personal bank. They see most homeowners as a means to make a withdrawal. Everyone is trying to keep up with the Jone’s and are maxing out their credit cards, then taking out a second mortgage. There are a thousand glowing eyes in the night, watching every hunk of beef that moves.

When Michael Harkins and I began our investigation in to how my sister – really died – I discovered Chazen had formed a partnership with Garth and Christine after Vic formed a partnership with his daughters. When I told my father this, the look on his face was classic. Here was a very greedy man who was just double-crossed by his greedy daughter. He was determined to get even, but, my sister was dead. Not for a second did he consider how I felt, because………….I wasn’t a player?

Game on!

Team Mattie & Willie were up against Team PlumpJack, and Team Oliver & Larry knew it. To let anyone – GO – was not good sport to them. They would look bad in front of their peers. We’re talking about a Feeding Frenzy!

Captain Vic owned to classic Chris-Craft that he docked in Martinez. Vic is hard at work as a Loan Shark in his Lafayette home. He smuggled his Mexican wife over the border in a marijuana shipment. He had ties to the Mexican Mafia. This is a mean man.

Jon Presco

http://www.theatlantic.com/politics/archive/2016/07/the-fall-of-debbie-wasserman-schultz/493019/

Members of Gavin Newsom’s wine, restaurant, bar, resort and real estate partnerships since 1991:

Kevin & Bronwyn Brunner, John Burton, Casey and Michelle Cadwell, Bob and Barbara Callan, Frank Caufield, Donna Chazen, Lawrence Chazen, Joe & Victoria Cotchett, Michael & Hilary Decesare, Philip DeLimur, Don Dianda, Gretchen Dianda, Edward Everett, Richard Freemon, James Fuller, Stanlee Gatti, Robert Gerry, Andrew Getty, Ann Getty, Anna Getty, Chris Getty, Gordon Getty, Mark Getty, Peter Getty, Ronald Getty, Tara Getty, William “Billy” Getty, Robert Goldberg,Florianne Gordon, Stu Gordon, Gordon Goletto, David Goodman, Arthur Groza, Richard & Martha Guggenhime, Tony and Anthony Guilfoyle, Shelly Guyer, James & Shea Halligan, Bob & Jill Hamer, Erin Howard, Thomas Huntington, Isolep Enterprises (Paul and Nancy Pelosi family personal investment company), Peter Jacobi, Gaye Jenkins, Jeffrey Kanbar, Chad Kawai, David Lamonde, John Larson, Rob Lavoie, Leavitt/Weaver interior designers, Marc Leland, Maryon Davies Lewis, Anne McCutcheon, Chris McCutcheon, Ross McGowan, Rich McNally, Robert & Carole McNeil, Paul Mohun, Robert Mohun, Jeff Morin, Sara Moughan, Terry Moughan, Brian Mueth, Bob Naify, Marshall Naify, John Nees, Barbara Newsom, Brennan Newsom, Catherine & David Newsom, Gavin Newsom, Patrick Newsom,

Tessa Newsom, William Newsom, John O’Hara, Jack Owsley, Pacific Design, Matt Pelosi, Robynne Piggott, James Samuel Powers, Elizabeth Rice, Jeremy Scherer, Paul Scherer, Gary Schnitzer, Steve & Theresa Selover, Steve Siino, Trevor Traina, Chris Vietor, Francesca Vietor, Kenneth Weeman, Nicki West, Justin & Aridne Williams, Kevin Williams, Thomas & Kiyoko Woodhouse.

William Zanzinger, who at twenty-four years

Owns a tobacco farm of six hundred acres

With rich wealthy parents who provide and protect him

And high office relations in the politics of Maryland

Reacted to his deed with a shrug of his shoulders

And swear words and sneering, and his tongue it was snarling

Zantzinger continued to collect rents, raise rents, and even successfully prosecute his putative tenants for back rent.[1] In June 1991, Zantzinger was initially charged with a single count of “deceptive trade practices.”[1] After some delay, Zantzinger pleaded guilty to 50 misdemeanor counts of unfair and deceptive trade practices.[17] He was sentenced to 19 months in prison and a $50,000 fine.[18] Some of his prison sentence was served in a work releaseprogram.[19]

In 2001, Zantzinger discussed the song with Howard Sounes for Down the Highway, the Life of Bob Dylan. He dismissed the song as a “total lie” and claimed “It’s actually had no effect upon my life”, but expressed scorn for Dylan, saying, “He’s a no-account son of a bitch, he’s just like a scum of a scum bag of the earth, I should have sued him and put him in jail.

In 1993, one of Aikens’ daughters recommended a contractor, Charles Jamerson of Fremont, because he had done some work for her boss. He, in turn, recommended Oliver as someone who could make the financing arrangements for him to begin work, Mattie Aikens said.

On Sept. 10, 1993, Oliver came to the house and spread dozens of loan documents across the brown kitchen table for Aikens and her son to sign. Oliver and Wilbert Aikens sat at the table, while Mattie mostly walked around the kitchen between signings.

Wilbert said he did recall the balloon payment being briefly discussed – but he was not left with the impression that the house would be jeopardized.

http://www.restauranteur.com/grasings/menu.htm

http://www.dailymotion.com/video/xpo27l_bob-dylan-the-lonesome-death-of-hattie-carroll_music

Mattie Aikens v. First Capital Finance: As alleged in court documents (24), Mattie Aikens is a 79-year old African-American widow and a resident of Oakland, California. Mrs. Aikens alleged that before becoming involved in the loan which is the subject of this litigation, she owned her home free and clear except for a $23,000 first deed of trust. She alleged that her income consisted of social security and a small pension. According to Mrs. Aikens, she has a minimal education and was not well versed in financial matters.http://shierkatz.com/wp-content/uploads/2013/04/Aikens.pdf

Mrs. Aikens alleged that she decided in early 1993 to fix the foundation to her house which was damaged in the Loma Prieta earthquake of 1989. She contacted a contractor who toured her house. According to Mrs. Aikens’ court complaint, after the contractor reviewed her home, the project expanded from only foundation repair to include an entire house remodel, including turning the downstairs garage into living quarters. She alleges that the contractor led her to First Capital Finance (First Capital), a mortgage brokerage company, in order to arrange the financing for the work. First Capital required a co-signer for the loan. According to court documents, the contractor estimated that the work would cost $88,073.

Mrs. Aikens and two of her sons signed a home repair contract with the contractor which Mrs. Aikens now alleges did not comply with many aspects of the law governing home improvement contracts. She also alleges that the contract failed to include required notices about certain homeowners’ rights to a mechanics lien release and their right to require the contractor to provide a performance bond.

Mrs. Aikens’ legal complaint states that First Capital proposed a 30-year fixed loan in a gross amount of $121,600 to be paid out over seven years, with monthly payments of $1,464.90 and a final balloon payment of $120,080. The proposed interest rate was 14.25 percent and the transaction fee would have been $15,791. Mrs. Aikens alleges that after an appraisal was completed, which was part of the loan proposal, there were a series of changes made to the work contract. According to court documents, those changes were not properly signed off by all of the parties to the original work order, as the law requires. Mrs. Aikens alleges that eventually, the lender drew up a promissory note which was for a principal amount of $160,750 at an interest rate of 13.5 percent for eleven months with a final balloon payment of $162,172 due in the twelfth month. Monthly payments on the note were $1,841.25, increasing Mrs. Aikens’ total monthly indebtedness to $2,291.25 (25). Mrs. Aikens’ alleges that the principal included $17,480 in fees to First Capital and of this amount, $16,075 was taken by First Capital as a “loan origination fee.”

Mrs. Aikens and her son Wilbert allege that a First Capital representative, Mr. Oliver, had assured them they shouldn’t worry about the balloon payment because the contract would be “re-written” at the end of the first year. According to court documents, he told them that when that happened, their payments would go down and they would have a regular 30-year loan. They allege that based upon this oral representation, they signed the loan documents. The loan documents, however, did not contain this assurance. According to court documents, when the first 12 months had passed, First Capital offered Mrs. Aikens and her son, Wilbert, not a conventional 30-year loan but another balloon payment loan for a total new debt of $240,000.

Mrs. Aikens alleged that in the end, the work the contractor performed was substandard at best. According to court documents, the Aikens’ home roof leaks worse than it did originally. The downstairs walls are covered in mildew caused by poor drainage and/or the leaky roof. There is no working electricity in the living room and hallway. The house continues to slope in large areas caused by the foundation problems. Mrs. Aikens alleged that balconies were removed from in front of French windows, and were never replaced, creating hazardous conditions.

According to court documents, Mrs. Aikens and Wilbert attempted to refinance the First Capital loan with her senior lienholder, American Savings. According to Mrs. Aikens, they obtained approval on a 30-year finance of the First Capital loan. Court documents allege, however, that before the close of escrow the contractor made a demand on the American Savings escrow, claiming he hadn’t been paid for $18,000 of work on the Aikens home. He then filed a mechanics lien. Court documents allege that these actions effectively ended Mrs. Aikens’ hopes of refinancing the First Capital loan with one by American Savings.

The court documents allege that when the family refused to enter into a new agreement with First Capital, the property went into foreclosure. Mrs. Aikens filed Chapter 13 bankruptcy to stop the foreclosure sale. Mrs. Aikens home was sold through a trustee’s sale. When Mrs. Aikens was about to be evicted from her home, her story made the front page of the San Francisco Examiner (26). Mrs. Aikens’ plight immediately drew the interest of concerned regulators who prompted investigations into the origins of Mrs. Aikens case. The United States Department of Housing and Urban Development (HUD) commenced an immediate investigation into First Capital based upon allegations of violations of the Fair Housing Act made by Mrs. Aikens. That investigation is ongoing.

On April 10, 1998, First Capital (also known as Homeowners Resources Corporation) and its principals, Charles Oliver and Cynthia Cecil Oliver, filed a complaint for damages against several news organizations and Consumers Union alleging defamation in the form of libel and slander. Consumers Union denies these allegations (27).

HAS the party of Lincoln just nominated a racist to be president? We shouldn’t toss around such accusations lightly, so I’ve looked back over more than 40 years of Donald Trump’s career to see what the record says.

One early red flag arose in 1973, when President Richard Nixon’s Justice Department — not exactly the radicals of the day — sued Trump and his father, Fred Trump, for systematically discriminating against blacks in housing rentals.

I’ve waded through 1,021 pages of documents from that legal battle, and they are devastating. Donald Trump was then president of the family real estate firm, and the government amassed overwhelming evidence that the company had a policy of discriminating against blacks, including those serving in the military.

To prove the discrimination, blacks were repeatedly dispatched as testers to Trump apartment buildings to inquire about vacancies, and white testers were sent soon after. Repeatedly, the black person was told that nothing was available, while the white tester was shown apartments for immediate rental.

A former building superintendent working for the Trumps explained that he was told to code any application by a black person with the letter C, for colored, apparently so the office would know to reject it. A Trump rental agent said the Trumps wanted to rent only to “Jews and executives,” and discouraged renting to blacks.

Donald Trump furiously fought the civil rights suit in the courts and the media, but the Trumps eventually settled on terms that were widely regarded as a victory for the government. Three years later, the government sued the Trumps again, for continuing to discriminate.

In fairness, those suits date from long ago, and the discriminatory policies were probably put in place not by Donald Trump but by his father. Fred Trump appears to have been arrested at a Ku Klux Klan rally in 1927; Woody Guthrie, who lived in a Trump property in the 1950s, lambasted Fred Trump in recently discovered papers for stirring racial hatred.

Yet even if Donald Trump inherited his firm’s discriminatory policies, he allied himself decisively in the 1970s housing battle against the civil rights movement.

Another revealing moment came in 1989, when New York City was convulsed by the “Central Park jogger” case, a rape and beating of a young white woman. Five black and Latino teenagers were arrested.

First Alliance Mortgage Co. Cases: Five lawsuits were filed in the San Francisco Bay Area against First Alliance Mortgage Co. since August 1996. These suits include significant private attorney general causes of action for unlawful and unfair business practices. Some of the alleged practices include misrepresenting the nature and terms of loans, not providing borrowers with required disclosures and documentation, rushing borrowers through the loan closing process, and deliberately covering up disclosure information while directing borrowers to the signature line on documents. Some borrowers allege that First Alliance induced them to sign separate mandatory arbitration agreements which would bar their access to having a court of law decide any dispute with between these borrowers and the company. They say that they did not know they were signing such an agreement and that they did not intend to enter into any such arrangement with First Alliance. So far, the courts have refused to enforce these agreements in four instances.

Several of the lawsuits have been filed on behalf of indigent elders. In some cases, plaintiffs suffered from physical and mental disabilities. In many cases, borrowers allege they did not meet their borrowing objectives, were placed in loans far in excess of what they requested, and paid loan origination fees far in excess of what they were told.

The remedy requested is injunctive relief as well as disgorgement of illicit profits. If successful, the litigation seeks to recover disgorgement of the total volume of loan origination fees (or between $20 and $30 million dollars per year) for four years. Currently, these cases are in litigation.

On May 6, 1998, The American Association of Retired Persons (AARP) filed a motion to join the lawsuits. “AARP takes very seriously these abusive financial practices aimed at the most economically vulnerable homeowners,” said Nina Simon, an attorney with AARP Foundation Litigation. “The Association is ready to take legal action against those lenders who prey on older homeowners,” she added. AARP charges that First Alliance Mortgage Co., one of the largest subprime lenders, targets the most vulnerable homeowners and charges fees eight to ten times those of mainstream banks or savings and loans. According to AARP, the victims, typically older homeowners, often end up losing the equity in their home and have no way to replenish their lost “nest egg.”

Litigation is but one avenue to pursue to seek redress for those wronged by unscrupulous lending practices. Homeowners with serious cases of home equity lending fraud and abuse are finding more help as more lawyers become proficient in managing the complexities of these cases. Cases involving home equity lending fraud and abuse have taken on a higher profile as the public has become more aware and outraged about lending practices that exceed the bounds of what is acceptable even though in some cases, those practices may not be illegal.

TRAINING, EDUCATION AND ADVOCACY

1997-04-13 04:00:00 PDT OAKLAND — When the roof started leaking and the foundation started slipping on Mattie Aikens’ home of 37 years, she knew it was finally time to scrape together some money to make the necessary improvements.

So she did what she thought was best: She took out a loan and looked forward to living in her home for many more years.

It may have been the worst decision of her life.

Now, with her roof still dripping and her two-story house in the Oakland hills in far worse condition than before, the 78-year-old widow is about to evicted.

After Aikens was unable to come up with a stunningly large single payment on the loan – more than $160,000 – within a one-year deadline, the lender foreclosed. At least two other similar cases involved loans arranged by the same company.

“They stole my house,” Aikens said. “And I paid them to steal it.”

She was told she wouldn’t have to worry, Aikens recalls, when she put her shaky signature on a formal-looking financial agreement filled with sophisticated phrases. But she is filled with worry as her April 24 eviction looms.

“This disturbs me awful bad, baby. I be in tears. I be in tears all the time,” she said recently as she stood outside the home where she raised her 10 children, and where many of her 57 grandchildren and great-grandchildren regularly visit her. “I’ve never harmed one person in my life. And now look what’s happened to me.”

What happened to her – and to dozens of other seniors in the area, according to an Oakland housing counselor – is that they signed intricate loan documents to fix their homes, often after being wooed by brokers who told them they could repay them with low monthly payments.

Many of the loans have “balloon payments,” when the entire balance of the loan is due after years – or just months – of low payments. But that important detail was not adequately explained to them, Aikens and others say – and if it had been, they would not have agreed to the deal.

Court documents show that the same company – First Capital Finance in Hayward, a partnership run by Robert Cox, Charles H. Oliver Jr. and Cynthia Cecil Oliver – has made at least two other loans following the same formula. The firm has since folded, and its owner, Cox, pleaded guilty to six counts of grand theft. He is serving time at Folsom State Prison for defrauding investors.

The cases both involve single, elderly women with no experience in such transactions and living on modest fixed incomes. Both said in court documents that they were not told of the balloon payments and were devastated when faced with foreclosure.

Seniors are often targeted because their homes are valuable and they are not educated about the terminology of loan transactions, say lawyers and consumer advocates. In many cases, the mortgages are almost paid off. Aikens owed just $5,000 on her home and was living off the $1,000 a month she received from Social Security and her late husband’s pension.

Aikens said the contractor never even finished the job, leaving her home in such disrepair that some rooms have no electricity – and the roof still leaks.

“This is the archetypal story of an elderly, minority widow being taken advantage of to extreme levels,” said Paul Daly, assistant manager of a San Ramon bank, who tried unsuccessfully to help bail Aikens out of her financial woes.

“It is evident that the contractor and lender were, and are, intent on foreclosing and subsequently taking over the property due to the level of equity of the property,” he wrote in an internal memo sent to another bank official while investigating the situation.

Son cosigned loan<

Aikens’ loan was handled by Charles H. Oliver Jr. of First Capital Finance – who has since started another company,Homeowners Resources Corp., also in Hayward.

Oliver refused to discuss details of Aikens’ situation – or any connection with First Capital Finance – because of confidentiality restrictions, other than to say the transaction was legitimate.

“There was full knowledge and disclosure, but it is an unfortunate situation,” he said.

He also said Aikens’ eldest son, Wilbert, cosigned on the $160,000 loan, and should have been fully aware of the agreement.

Reviewing Aikens’ truth-in-lending disclosure statement, Daly said there were telltale signs that the loan was troublesome.

The document, one of about 30 prepared in the loan process, reveals an unusually high annual percentage rate of 25.5 percent – “pretty much highway robbery,” Daly said, explaining that a normal rate is typically around 10 percent.

Another problem: The $162,172.21 balloon payment due in the 12th month was more than the original loan. In fact, much of the first 11 monthly payments of $1,841.25 went toward a $17,652.44 loan processing fee.

Other elderly hit by similar deals<

Oakland attorney Christine Noma – who represents the two other women who signed similar loan agreements with First Capital Finance – said some brokers prey on the elderly, knowing that most are unfamiliar with real estate deals.

When she questioned Cox, the First Capital Finance president, in a deposition last year, he conceded that one elderly borrower could not repay the loan without refinancing – or “she could win the lottery.”

“But was it your collective opinion that (the widow) did not have the income to save the money herself to pay off the balloon (payment)?” Noma asked.

“That is a given,” Cox replied.

Noma is concerned about the psychological impact for victims of such deals.

“The real damage is that elderly women are becoming homeless when they were once financially independent and living in their own house,” she said. “Suddenly, they are robbed of their independence … and are left struggling when they should be enjoying the last years of their lives.”

Unscrupulous loan brokers can pick targets by searching public records, pulling deeds and seeing who owns valuable homes that are nearly paid off, said Ray Leon, housing counseling supervisor for the Oakland Community and Economic Development agencies. They also can see whether a widow is the sole owner and can arrange to visit to see if repairs are needed.

“We’ve seen cases where these loans are arranged and the borrower barely has $50 or $100 left over to live off of,” Leon said.

“In other words, brokers are expecting foreclosure when making the loan,” said Robin Yamate of the Oakland-based Legal Assistance for Seniors. “And the seniors do not realize this.

“It’s really difficult to undo these deals because these are sophisticated lenders, and it’s very difficult for us to prove that the senior did not understand when they signed a disclosure statement that says they did,” she said.

The Aikens home<

Mattie Aikens, a lean woman who wears her hair neatly pinned up beneath a scarf, said she would not have signed had she been aware of the details. Her husband, Walter, whom she married when she was 13, handled the finances until he died in 1987. After the couple came to California from Missisippi in 1933, Mattie worked in the fields and at canneries while Walter was employed as a warehouseman.

Everyone in the family agrees that by 1993 the home – built in 1910 – needed repairs. The roof leaked, and they believed some remodeling would make it easier for Aikens to handle household chores.

In 1993, one of Aikens’ daughters recommended a contractor, Charles Jamerson of Fremont, because he had done some work for her boss. He, in turn, recommended Oliver as someone who could make the financing arrangements for him to begin work, Mattie Aikens said.

On Sept. 10, 1993, Oliver came to the house and spread dozens of loan documents across the brown kitchen table for Aikens and her son to sign. Oliver and Wilbert Aikens sat at the table, while Mattie mostly walked around the kitchen between signings.

Wilbert said he did recall the balloon payment being briefly discussed – but he was not left with the impression that the house would be jeopardized.

“(Oliver) explained we would pay for the year, and then just before the end of the year, before the balloon was due, the contract would be rewritten and he would try to get the payments lowered,” Wilbert said. “Everything seemed on the up and up.”

To make it even easier, Oliver said he would arrange to oversee the payments to Jamerson himself, Aikens and her son said.

After 90 minutes, Oliver collected the papers in his briefcase, clicked it shut and was out the door with a smile and a handshake.

Jamerson’s construction left much to be desired, Mattie Aikens and her children said. Much remains unfinished, and the Aikens family has not heard from him since September 1994. Jamerson did not return a reporter’s repeated calls to his office seeking comment.

It was raining that September, Wilbert Aikens explained, and the family understood that some delay was necessary – even though some walls of the home were gone and left wide open while Mattie Aikens and three of her children continued to live there.

The weather cleared, but Jamerson did not return, saying that he needed more money to continue the work, Wilbert Aikens said.

Aikens and her children approached several lawyers with their case, asking for help – but the cost of retaining them was prohibitive.

“I can’t believe what he did to my house,” said Mattie Aikens, sitting in her dining room, which has side doors hanging from a splintered frame. “There was nothing wrong with those doors, but he took them down and then put them up like that.”

In the kitchen behind her, drawers are crooked and the linoleum curves over uneven flooring. Botched electrical work has left two rooms and the front hallway without power. Leaks in the roof and the foundation cause greenish-black mildew to crawl up the walls of downstairs rooms.

Aikens became even more depressed after learning that Jamerson had filed a lien, thus preventing any refinancing. Ultimately, that led to eviction papers being hand-delivered to her March 28 – by Oliver himself.

“I couldn’t believe he could do that to me,” she said.

“If I have to move, I’ll just collapse. I don’t know if I can stand it.” <

Writers In Conflicting Treatment

Posted on June 2, 2021 by Royal Rosamond Press

Leave a comment